CAPTIVE

A Guide To Captive Insurance

In an increasingly dynamic and volatile global marketplace, the need to establish as well as maintain control over risk exposures is critical. This is evident in light of the unprecedented COVID-19 pandemic that is testing the resilience of economies and businesses world over.

In order to manage risks that may affect business operations, it is imperative for companies to develop and implement risk management programmes that support their strategic objectives, mitigate against new exposures and probe for emerging threats.

To this effect, captive insurance has proven to be a valuable and powerful business-planning tool for managing risks in a formal, measurable and tax-efficient manner.

What Is A Captive?

A captive is an insurance or reinsurance company established to provide coverage primarily for a noninsurance parent company. Essentially, a captive insurance company is a type of corporate selfinsurance, which are typically formed to meet the risk management needs of a company.

Captive can be a valuable risk management tool that allows businesses to more effectively manage corporate risks, especially risks for which commercial insurance is not available or may be too expensive.

Why Form A Captive?

Establishing a captive insurance company provides significant benefits to companies in managing risks effectively and control their insurance costs. A properly implemented captive provides a number of advantages including:

Reduced Insurance Costs

Higher deductibles and lower premiums with third party coverage creates increased cash flow to the business owner, with no greater risk.

Asset Protection

Assets of a captive company can and should be protected from predators and creditors when properly structured and maintained.

Increase Coverage & Greater Control Over Claims

A captive establishes and controls its own claims handling policies and procedures, and has full access to all claims data.

Asset Growth

As the business ages, the claims experience becomes more predictable as the claims reserving and payment strategy is set by the captive owners. This results in more significant cost savings and asset growth over time.

Underwriting Flexibility

A captive is able to customise its own coverage where it is unavailable or unaffordable during the underwriting process.

PROTECTED CELL COMPANY

Captive Using Protected Cell Company

Establishing a protected cell company (PCC) or ‘cell captive’ is a relatively simple and inexpensive way for a company that is new to captives to enjoy the many of benefits of retaining risk within a captive structure.

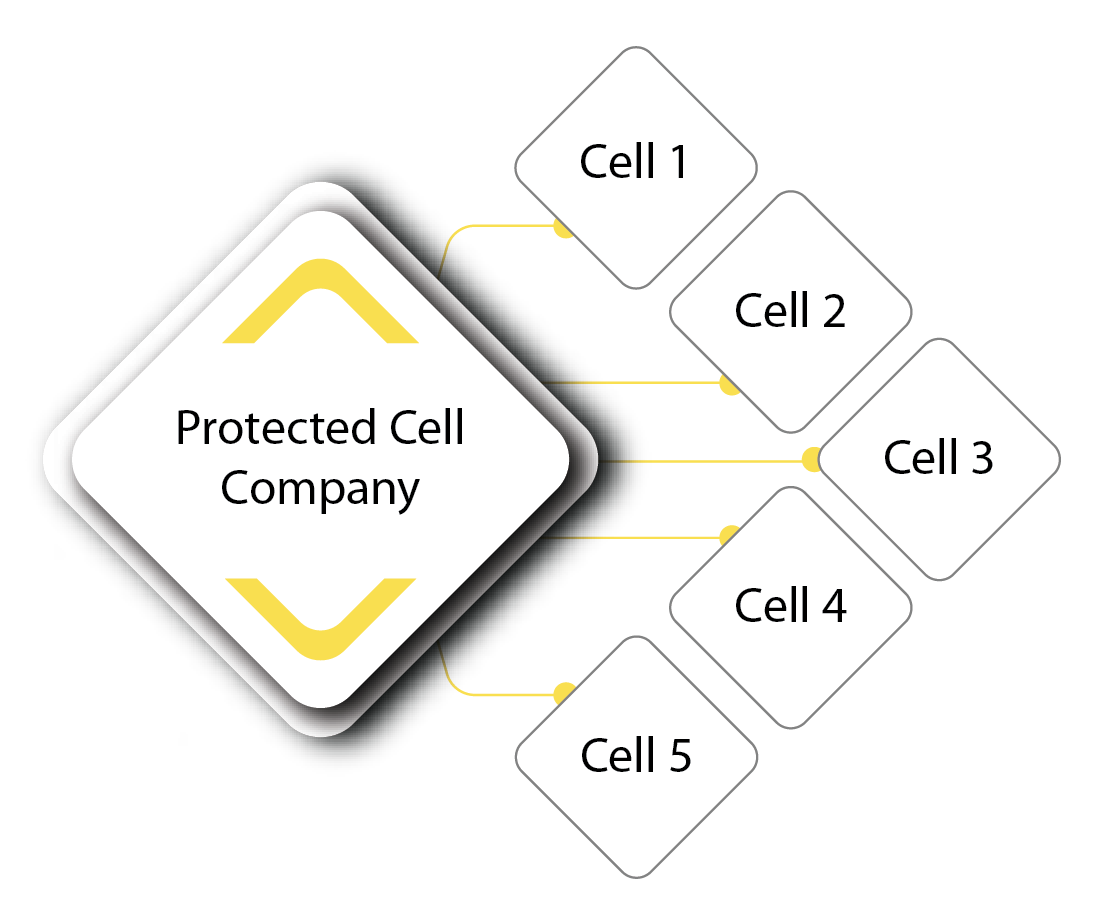

Under a PCC, a limited liability company is structured to form cells where each business entity is legally segregated from all other incorporated cells in the PCC. Therefore, PCC allows for the segregation of risks, assets and liabilities of different cells under a shared structure.

In a PCC structure, assets and liabilities of one cell are legally ring-fenced from other cells and the core, i.e. the PCC. Hence, creditors of a cell in a PCC structure only have recourse to the assets of that particular cell.

PCC offers similar advantages to traditional captives but with additional benefits: cells are legally segregated from each other and it offers the benefits of a captive without the same level of financial commitment and associated costs.

Who Is A PCC Suitable For?

It is an ideal solution for:

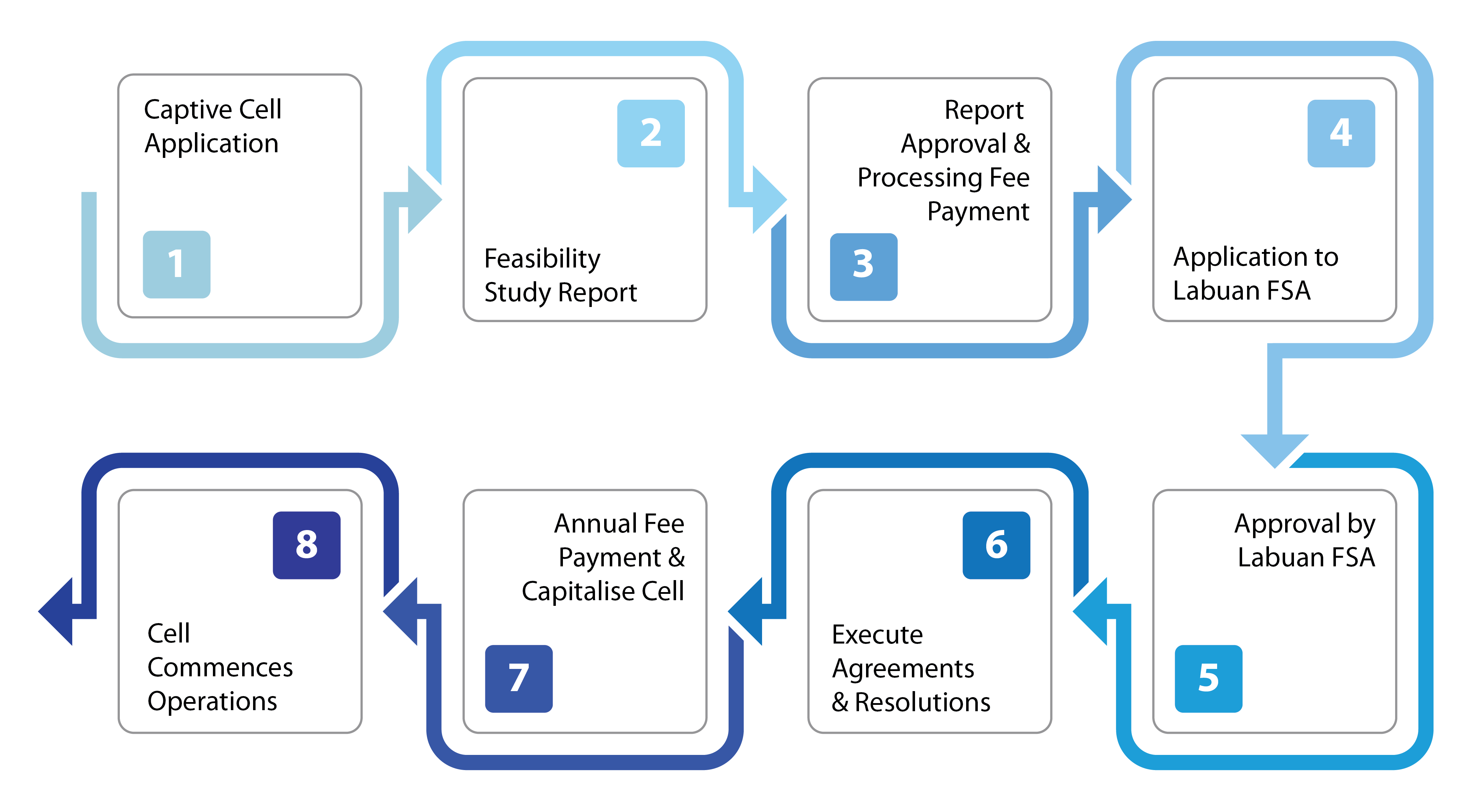

Establish a Cell